Get the most out of QuantXpress with comprehensive guides and tutorials on all of our products and Solutions.

QuantXpress empowers you to create and customize powerful trading systems. Build bespoke trading applications, strategies, and tools to streamline your trading workflow and bring your algorithmic edge to life. Get started quickly with our extensive developer resources: sample code, articles, tutorials, and API.

BlitzTrader delivers a comprehensive trading solution designed to automate and streamline your Strategy development and trade automation processes end-to-end.

Before diving into strategy development, familiarize yourself with key concepts of BlitzTrader.

BlitzTrader's open architecture allows rapid transition from idea conception to live deployment, enabling traders to capitalize on market opportunities in matter of days.

Explore strategies further by examining the code of various pre-built strategies for different asset classes and trading rules.

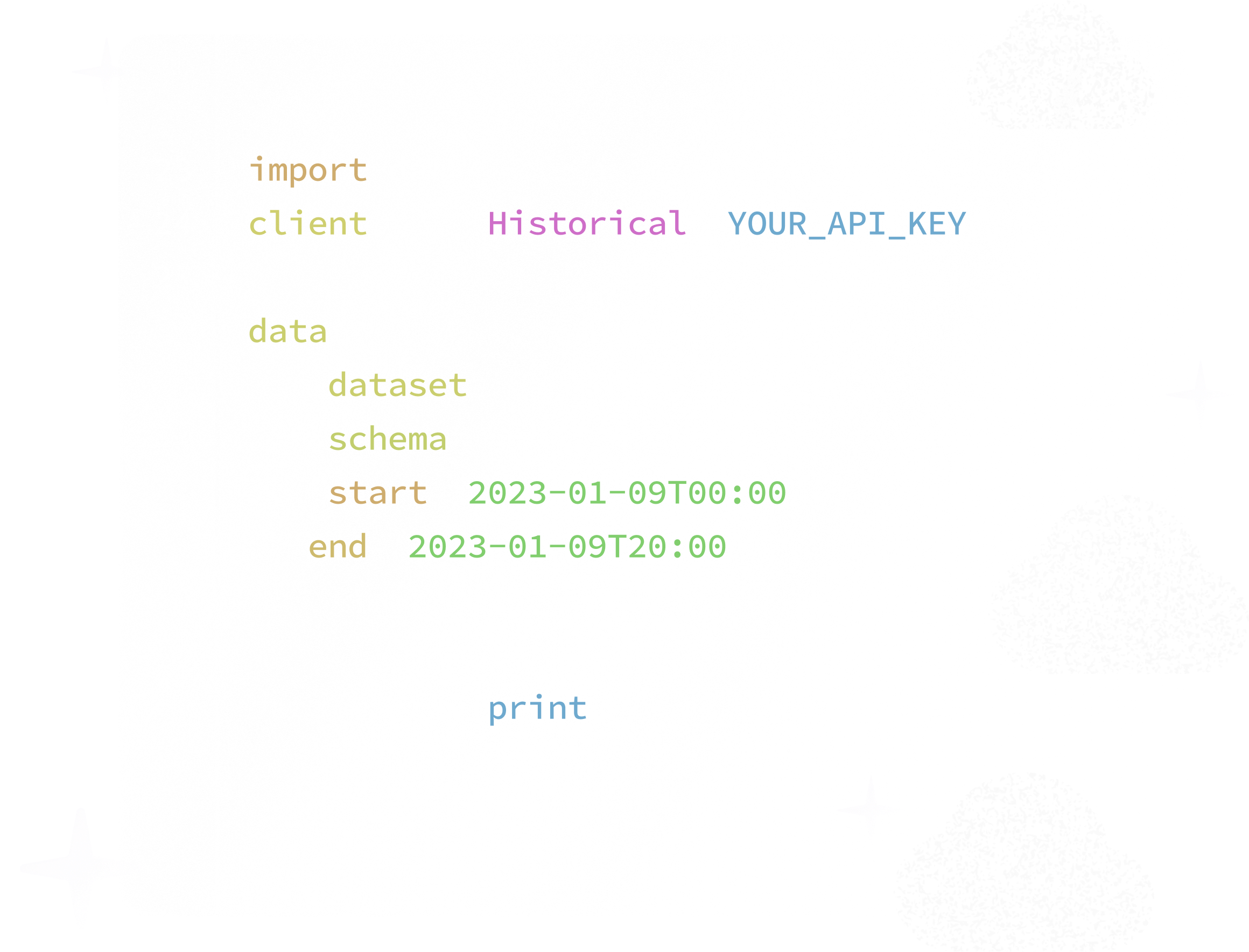

Leverage the QX.FinLib SDK and developer resources to develop strategies, conduct backtesting, and build analysis and trading tools

Tutorial guides you through hands-on exercises to build skills and familiarity with the strategy research process.

Discover QX.FinLib SDK to build a backtest strategy and put them to work.

Explore sample code for various strategies across options and other asset classes.

The QX.FIXEngine SDK are implementation of the FIX protocol that provides an easy to integrate FIX API for industry standards based electronic trading communications.

Tutorial guides you through different component of QX.FIXEngine to build and integrate FIX Engine and parser in your application.

A selection of code samples for you to use to accelerate your FIX Engine development

This article guides you through simple steps on how to build straddle and strangle options strategies using the QX.FinLib SDK

The QX.FinLib framework offers an easy setup for utilizing standard indicators as well as developing proprietary indicators tailored to your specific needs.

The Smart Order feature is a core component of the SDK, designed to streamline and enhance the robustness of your order execution logic, providing greater control over your trading operations.

Kickstart your algorithmic trading journey in C#. Learn how to set up your environment, code strategies, and automate trades to enhance your market decision-making.

Tick-by-tick (TBT) data represents high-bandwidth order book information. This article explains how to effectively handle and manage this volume of data in your program.

Sample apps demonstrating the features of the BlitzTrader, QX.FinLib, QX.FIX Engine and other products SDK

This article provides step-by-step instructions for developing a basic application that exchanges financial information over the FIX protocol within a .NET environment

Our plan is to empower retail traders by providing access to algorithmic and automated trading solutions, enhancing their financial journey towards robust trading success.

Technology

Algorithmic trading, or "algo trading," refers to the use of computer programs to automatically execute trades in financial markets based on predefined rules and strategies. This method has revolutionized the way trading is conducted, enabling traders to operate with unprecedented speed and efficiency.

Technology

In the landscape of algorithmic trading platforms, Blitz stands out as a revolutionary solution. Unlike traditional platforms that offer limited flexibility with predefined strategies, Blitz allows traders to create their own unique trading strategies autonomously.

Technology

In the ever-evolving landscape of financial markets, technology plays a pivotal role, revolutionizing the way trading is conducted. The advent of electronic trading marked a significant turning point, transitioning markets from manual outcry systems to automated electronic networks.